From Investment to Impact: Boosting ROI Through Employee Benefits

Contents

More than half of job searchers aged between 18 and 34 say that a good benefits package is the most important thing they look for when considering a new role.

Employee benefits have come to be an expectation rather than an added bonus, offering as much value to the workforce as they do to the employer. According to CIPD, a strong benefits package can help leaders “attract and keep people, contribute towards improving wellbeing, and encourage required behaviours, achievements, values, and skills.”

While employee benefits require an initial investment, the return is often significant. The biggest downfall, however, is that many organisations don’t assess the value of their investment. In fact, only 26% of business do.

Why is determining ROI important?

To unlock the full potential of your investment in employee benefits and ensure sustainable growth, it’s vital that business leaders take regular steps to review their ROI. Doing so will help you to:

- Strategically allocate funds and resources towards the best performing benefits

- Maintain your competitive advantage as an organisation that offers best-in-class benefits

- Identify any areas where you need to drive employee engagement

- Inform your decision-making around which benefits deliver the most significant impact

- Boost your recruitment and retention toolkits by showing the true value of your benefits to prospective employees

- Mitigate the risk of investing in future benefits which might not yield significant impact or align with your business goals

- Secure further benefits investment by demonstrating the value of your current offering

- Crystallise savings to create a budget for new initiatives

Did you know? 80% of employees would choose additional benefits over a pay raise

So, what can you do to ensure you’re making the most of your employee benefits and generating a positive ROI?

In order to calculate ROI, you need to work out what you have gained in terms of the purpose of your chosen benefits as demonstrated in this equation:

Setting Goals and Measuring Success

When choosing your employee benefits, you likely had a reason in mind for option for that particular package. This might have been to boost retention, elevate your company culture, or enhance your engagement levels.

However, it can be difficult to measure the success (and subsequent ROI) of your benefits unless you know what you’re trying to achieve. Setting clearly defined goals enables you to narrow your focus and create an understanding of what success looks like for your particular organisation.

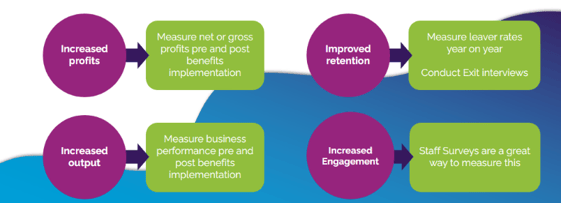

Your goals might include:

- Increasing profits

- Enhancing output

- Improving retention

- Elevating engagement

- Supercharging satisfaction

By putting goals in place, you can then decide on effective measures of success.

How to Use ROI Data

The beauty of measuring success means you can drive decision-making with data to justify why investing in employee benefits is so worthwhile. It also enables you to decide how best to act on your employee benefits offering - whether that be expanding, investing more in areas, or making efforts to encourage uptake.

Real World Results

It’s important to remember that ROI is not all about direct financial savings. Benefits like Cycle to Work and Car Leasing Schemes can save money while also contributing to your environmental and sustainability goals, helping to improve brand image in turn enhancing your ability to attract and retain top talent.

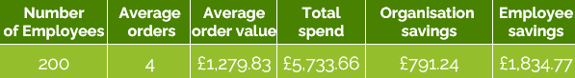

See how much your organisation and people could save with Vivup’s Cycle to Work benefit:

These figures are reflective of data from April 2024. Based on an average 2% take up, with 3% employer pension contribution and 5% employee pension contribution, using Vivup Cycle to Work data.

How to Improve ROI

One of the biggest problems that can lead to low ROI stems from a simple lack of awareness. 41% of companies don't provide their staff with regular updates on the benefits they have available to them, which unsurprisingly has a knock-on effect on uptake and engagement.

By implementing a solid communications strategy before you deploy your benefits, you can generate excitement, encourage usage, and set the foundations for a positive return on investment.

To communicate your offering effectively, you can:

- Send engaging and informative emails

- Schedule insightful Lunch and Learn sessions

- Create an easily accessible library of explainer videos

- Host question and answer sessions

Another great way to maximise your ROI is to tap into your employees’ unique insights. By engaging with them directly, you can uncover valuable feedback around the benefits that are making an impact and discover ways to tailor your offering to best support them for success.

You can gather this information by providing staff with surveys that generate statistics on value and useage, and by regularly checking your MI data.

Making Data a Doddle

Here at Vivup, we make easy work of capturing essential data. We provide MI data and reporting to give you clarity on registration figures, order numbers, usage breakdowns, organisational savings, key mental health topics, and more.

To discover how we can help you elevate ROI with a best-in-class benefits package, get in touch with us today.

Terms & Conditions

Up to 42% saving: Savings are realised through a salary sacrifice arrangement. Excluding End of Agreement fee (if applicable). Figures are a guide only and dependent on personal situation. Cycle to Work is provided via a salary sacrifice arrangement. T&Cs apply.

At least 50% of the cycle and/or safety equipment must be used for qualifying journeys including: commuting to and from work and/or business journeys from one workplace to another. Bikes available are subject to organisation scheme limit.

Local Bike shop: Ordering through your local bike shop or Evans Cycles is only available through you Cycle to Work employee benefit. Bike Shop Net is provided by a salary deduction and is taken from your net pay. Tax and NI savings do not apply. T&Cs apply.

For bicycles valued over £1000 your organisation is a broker and not a lessor. SME HCI Ltd (Trading as Vivup), is authorised and regulated by the Financial Conduct Authority. UK only, 18+, Subject to status, terms apply.

T&Cs apply. In order to take a car on the car employee benefit, you need to be a permanent and paid employee who has completed their probation, or if you are on a fixed term contract, your contract of employment must be for a longer period than the proposed Salary Sacrifice Agreement. Your gross salary must be above the National Living Wage or National Minimum Wage after all salary sacrifice arrangements have been taken (Not including commission, bonuses, overtime or additional payments unless guaranteed).

If, prior to arranging delivery of the vehicle, you decide that you no longer want to participate in the scheme you can cancel your order by telephoning the Tusker Driverline. You may be required to pay a cancellation charge. This will be notified to you at the time of cancellation. Car employee benefit is provided via a salary sacrifice arrangement and you will be participating in Hire agreement.